Gold Coins vs. Gold Bars: Which Is the Better Investment?

Gold has been a symbol of wealth for centuries. It has been a medium of exchange, a store of value, and a hedge against inflation. Today, as we face economic uncertainty and volatile financial markets, gold investments have regained popularity. However, if you're new to investing in gold, you may wonder, should I buy gold coins or bars?

Both gold coins and bars have their advantages and disadvantages. Let's explore the differences between the two and determine which is the better investment.

Gold Coins - The Pros

First and foremost, gold coins are readily available in a variety of sizes and denominations. Coins are minted by government mints worldwide, making them easy to acquire. Moreover, gold coins are easily recognizable, making them easier to sell. You could easily sell your gold coins if you suddenly need cash during an emergency.

Another advantage of gold coins is the numismatic value or the value of the coin itself beyond the value of gold. Rare or historic coins are more expensive due to their rarity and historical significance. Rare coins have the potential to appreciate over time faster than the price of gold. Also, many coin collectors are interested in acquiring rare coins, which can increase their value.

Gold Coins - The Cons

The biggest disadvantage of gold coins is that they typically carry a higher premium than gold bars, making them more expensive. The premium is essentially the cost of minting and distributing the coin and the dealer's markup. Therefore, shopping around to find the best price when buying gold coins is important.

Another downside of owning gold coins is the risk of damage or theft. Gold coins are small and portable, which can make them a target for theft. Also, if a gold coin is damaged, its numismatic value may be reduced or even eliminated.

Gold Bars - The Pros

The biggest advantage of gold bars is their lower premium over the spot price of gold. Gold bars are sold at a lower markup than gold coins, which means you get more gold for your money. Thus, gold bars might be better if you buy gold as an investment rather than for collecting.

Gold bars are also relatively easy to store and transport. However, storing them in a safe and secure location is still important.

Finally, gold bars are worth their weight in gold. Gold bars have no numismatic value, which means their value is entirely based on the weight and purity of the gold. This makes gold bars an excellent way to invest in gold without the additional risk and expense of rare or historic coins.

Gold Bars - The Cons

The biggest disadvantage to gold bars is their lack of divisibility. Gold bars are available in a variety of weights but typically range from 1 gram to 1 kilogram. If you want to sell a portion of your gold investment, you may have to sell a whole bar, which could be inconvenient.

Gold bars also lack the historic and collector's value that gold coins can have. Gold bars may not be your best investment if you like collecting rare and historic coins.

Weighing the Pros and Cons

So, which should you choose - gold coins or gold bars? Ultimately, it depends on your goals as an investor. Gold bars might be better if you want to invest in gold as a safe haven asset and don't care about numismatic or collector's value. However, if you're interested in collecting rare coins or want to invest in gold in smaller denominations, gold coins might be the better choice.

Whatever you decide, remember to do your research and buy from a reputable dealer. Don't be swayed by fancy packaging or claims of unlimited profit potential - there's no sure thing in investing. Invest in gold as part of a diversified portfolio and be prepared to hold it long-term.

Contact Phil’s Coins Today

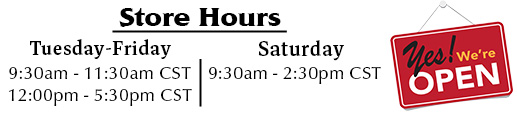

Are you ready to invest in gold? Phil's Coins has a wide selection of gold coins and bars to choose from. Our knowledgeable staff can help you choose the right investment for your goals and budget. Visit our website or stop by our store today and start investing in your future.